News

- 17 July 2024

- 950 Views

- Source: mordor intelligence

17Jul

UAE Oil and Gas Market Analysis

The UAE oil And gas market size is expected to grow from 3,300 thousand barrels per day by the end of this year 3 to 4,939.24 thousand barrels after five years, at a CAGR of 8.40% during the forecast period.

- Over the medium term, factors such as increasing investment in the upstream sector coupled with supportive government policies are expected to drive the market's growth during the forecast period.

- On the other hand, the plans to diversify the power generation mix by introducing renewable energy sources are expected to hinder the market's growth during the forecast period.

- Nevertheless, the increasing demand for LNG in the country leads to the integration of smart technologies in the existing LNG infrastructure, creating ample opportunities for the market players during the forecast period.

UAE Oil and Gas Market Trends

The Upstream Sector to Dominate the Market

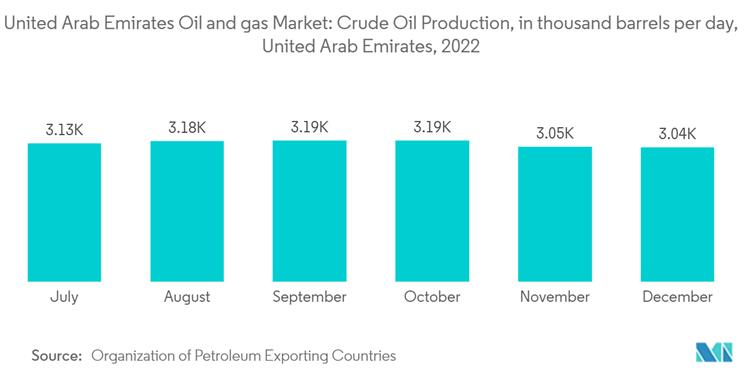

- The upstream segment is likely to dominate the market druing the foreacts period owing to the increasing investment in the sector across the country. According to Organization of Petroleum Exporting Countries, in December 2022, the United Arab Emirates's oil production, was about 3,043 thousand barrels per day.

- The country's natural gas increased by one trillion standard cubic feet (TSCF) and hydrocarbon reserves increased by 2 billion stock tank barrels (STB) of majorly Murban-grade crude. About 96% of the total reserves are in Abu Dhabi, followed by Dubai, Sharjah, and Ras al-Khaimah. Most of the onshore and offshore acreage is relatively well explored, while the recent drilling has yielded a few significant discoveries.

- In May 2022, Abu Dhabi National Oil Company (ADNOC) announced the discovery of 650 million barrels of offshore crude oil reserves in Abu Dhabi.

- Additionally, in a bid to counter the production from the maturing fields, the country plans to increase investments in the field expansion projects and the application of enhanced oil recovery (EOR) techniques.

- Therefore, based on the above-mentioned factors, the upstream sector is expected to dominate the country's oil and gas market during the forecast period.